Reflections on leadership, governance and decision-making in complex institutional environments.

These pieces draw on executive practice, research and public life to explore how organisations navigate uncertainty, risk and long-term responsibility. They are written to clarify complexity, test assumptions and examine the systems that shape our economies, institutions and places.

November 2025

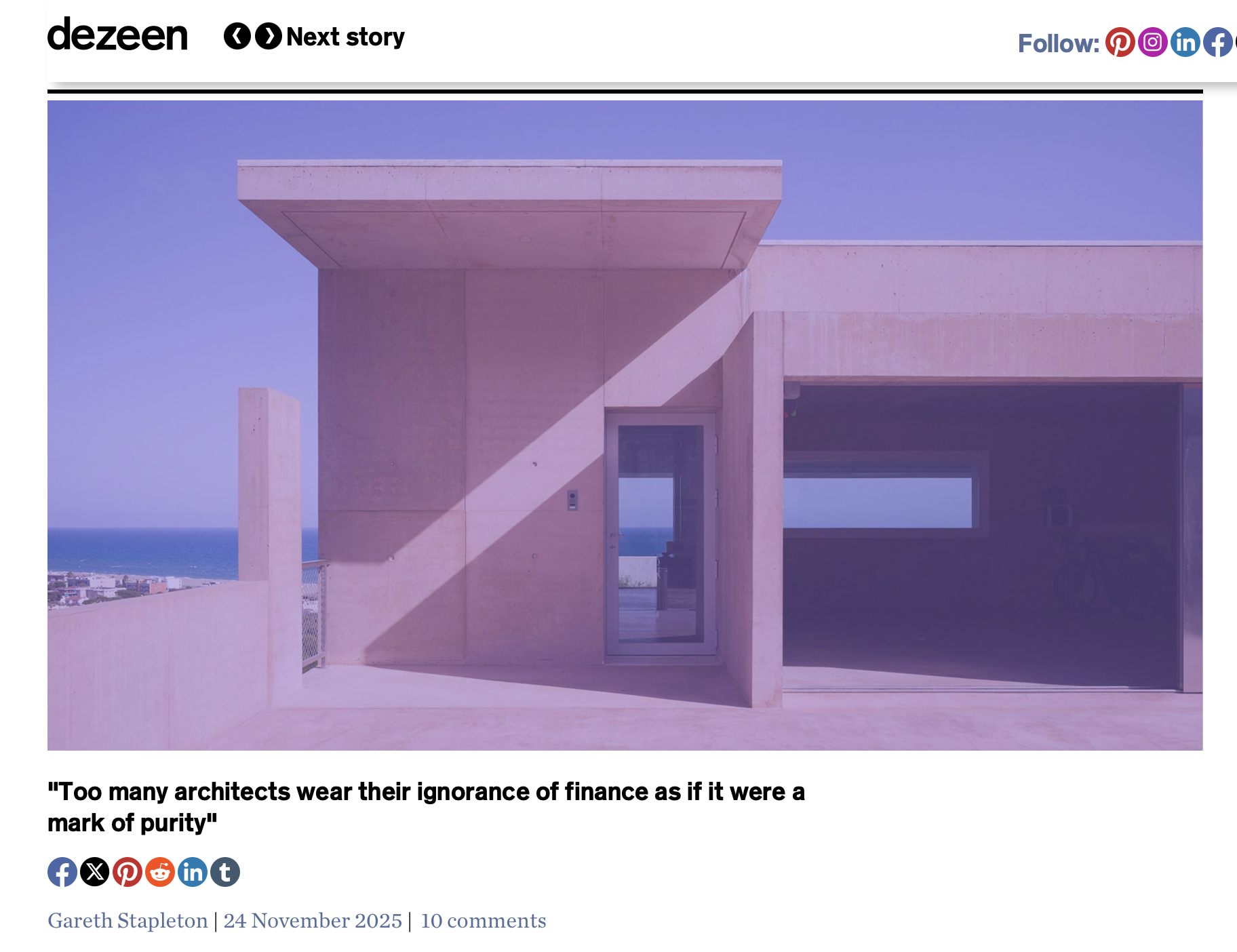

There were many moments while reading this article that I found myself enthusiastically nodding my head. Thank you Gareth Stapleton, for penning this piece, and Dezeen for publishing it.

'The lesson is blunt: the future belongs to firms that treat themselves as design problems. Just as we sketch facades, we must prototype business models, iterate on formats, redraw internal cultures. Creativity demands it. Discipline sustains it.'

Sarah Moylan - Heatherwick Studio

October 2025

“I’ve been mentally writing this article for years and I’m glad they took the time to. Thanks for sharing”

Sheldon Caterno - Cumulus Architects

National Security Is a Real-Asset Class

Canada’s Fall Budget and a New Architecture of Sovereign Capital.

National security is no longer a line item in Ottawa’s ledger; it has become a pricing convention in Canada’s built environment. When the federal government tables Budget 2025 on November 4, it won’t simply fund new projects; it will formalise a security premium across capital, valuation, and liquidity in real estate. In this emerging regime, buildings, land, and infrastructure are not just risk assets but instruments in the architecture of sovereignty.

This shift is explicit and structural. Starting in 2025, Ottawa has moved the main federal budget to the fall, pairing it with a new capital budgeting framework that separates operating from capital outlays and ties major spending to clearer, investment-grade rationales. The Department of Finance frames this as “modernising” budgeting to improve predictability for builders and investors, accelerate project starts, and make long-horizon investments, housing, infrastructure, and clean energy, easier to plan and deliver. Treasury Board policy already requires business cases for significant projects; the fall cycle and capital framework extend that discipline to the whole budget, aligning fiscal timing with how markets evaluate capital formation. A similar consolidation to an autumn budget improved implementation lead-times in the U.K. from 2017 onward.

The Myth: Security is a public expense, not an investment.

For decades, the usual view was that national security belongs to the public sector: defence, intelligence, and procurement. Private capital saw it as an externality or a compliance cost. Real estate, especially commercial real estate (CRE), was evaluated based on yield, location, and demographics, not on resilience, critical adjacency, or sovereign compatibility. That framing is stale. The shift in policy logic is now unmistakable: Security is capital formation. It imposes a floor on access, a markup on compliance, and a gatekeeper function in liquidity. Investors are learning that the price of entry now includes questions of clearance, cyber conformity, and supply-chain sovereignty, not just structural integrity or market risk. To see this shift is to read three converging lines of Canadian policy:

Defence & capital programmes are growing rapidly.

Under Our North, Strong and Free, Canada will invest $8.1 billion over five years and $73 billion over twenty years in defence, a trajectory that includes Northern and NORAD modernisation. Parliamentary Budget Officer analysis shows the long-term capital envelope increased by $51.5 billion since 2022, from $163.3 billion to $214.8 billion, with NORAD projects a major driver. Evidence of spending is already underway. Beyond planned envelopes, Ottawa is committing funds to projects on the ground. In July 2025, National Defence announced the first transmit and receive sites for the Arctic Over-the-Horizon Radar (A-OTHR), a major NORAD modernisation milestone drawing on the multi-decade funding line. In parallel, Defence Construction Canada has awarded $525 million in contracts to build new F-35 “super hangars” and associated secure facilities at 4 Wing Cold Lake and 3 Wing Bagotville, part of the Future Fighter infrastructure program already in delivery.

DND has also progressed international teaming for A-OTHR, signing a technology partnership arrangement with Australia in June 2025 to accelerate radar development and domestic industrial capacity, another signal of active program execution. On the fiscal side, Supplementary Estimates (A) 2025-26 added $9 billion in budgetary authorities across government, reinforcing near-term spending capacity as defence programs advance.

ICA modernisation raises the stakes of foreign capital

In March 2024, Parliament passed Bill C-34, amending the Investment Canada Act to strengthen national security reviews. The legislation allows the government to impose interim conditions while a review is underway and authorises the Minister to accept binding undertakings from investors to mitigate potential risks. In parallel, the updated National Security Guidelines (2025) now identify economic security as a core consideration, meaning that foreign investment will be assessed not only for ownership and control but also for its potential impact on Canada’s supply chains and innovation ecosystem. These changes expand the scope of scrutiny, drawing even “ordinary” sectors into review when transactions involve sensitive data, operational proximity, or perceived foreign state influence. Ottawa has already exercised these powers, ordering the dissolution of Bluvec Technologies and Pegauni Technology in May 2024 on national security grounds.

This approach brings Canada’s investment-screening regime closer to the United Kingdom’s National Security and Investment Act (2021), which codified similar powers of pre-notification, call-in, and intervention across strategic sectors. It is no coincidence that Prime Minister Carney, having served as Governor of the Bank of England during the UK’s own post-Brexit recalibration of economic sovereignty, is now applying that experience to Canada’s fiscal and regulatory architecture. His instincts in aligning monetary, fiscal, and security policy reflect the same discipline he exercised in London: using policy timing and institutional design to hard-wire market confidence into national strategy.

Critical infrastructure / cyber regimes converge

In June 2025, the government introduced Bill C-8, which would enact the Critical Cyber Systems Protection Act (CCSPA) and amend the Telecommunications Act. Once passed, the regime will designate vital services and systems and impose mandatory cyber and operational-technology (OT) standards on their owners and operators. Its momentum is already reshaping expectations: compliance will no longer be optional but a precondition for participation in critical-infrastructure markets. As this framework matures, landlords, tenants, and vendors will be judged not only on physical resilience but also on network architecture, intrusion detection, threat modelling, and recovery protocols, the operational grammar of modern security.

Crucially, this sits alongside data-sovereignty requirements already guiding public-sector workloads. The Government of Canada’s Direction for Electronic Data Residency requires that sensitive electronic data at the Protected B, Protected C, and Classified levels be stored in Canada, and the Treasury Board’s Cloud Guardrails set baseline controls departments must implement and report on, standards that cascade to cloud tenants, colocation providers, and their real-estate footprints. In practice, chief information officers are held responsible for ensuring Protected B data residency in Canada, which is why hyperscale and partner offerings now emphasise sovereign controls and local residency for government workloads. This policy environment is also shaping where capacity is being built: Canada’s data-centre market remains highly concentrated, with 93% of national IT load clustered in Toronto, Montreal, and Alberta, a geography that aligns power availability, fibre backhaul, and data residency/sovereignty preferences.

As this regulatory architecture takes shape, its effects are already visible in the market: security compliance is beginning to shape value itself, influencing land pricing, leasing diligence, and capital allocation. Together, these forces are repositioning security not as a drag on capital but as its baseline multiplier, the condition under which trust, liquidity, and investment now converge.

Market Reality: The Security Premium Is Already in Play

The market isn’t waiting for policy to catch up; the security premium is already materialising in real assets. You just have to look at where capital is clustering, what diligence demands, and how ownership is being re-priced. The data-centre frontier offers a textbook example. In Toronto, power-eligible land is now trading at a premium over standard industrial parcels, driven by the scarcity of grid capacity and demand from hyperscale tenants. Meanwhile, DCByte shows that 93 % of Canada’s current IT load is localised to Toronto, Montreal, and Alberta, underscoring concentration and site scarcity. Hyperscale operators, particularly those handling public or regulated workloads, now bake sovereignty into their real estate criteria: availability of resilient backhaul, fibre routes, dark-fibre corridors, and discriminatory routing.

Defence-adjacent clusters tell the same story. As the Department of National Defence invests in northern airfields, jetties, hangars and base expansions, new industrial nodes naturally form around them. Places like Inuvik, Yellowknife, Iqaluit, and Goose Bay figure prominently in NORAD modernisation plans, anchoring corridors of “mission adjacency.” In those zones, developers are no longer building generic warehouses; they’re specifying secure labs, shielded manufacturing, and hardened logistics.

Foreign Capital is recalibrating. With Bill C-34 in force, Guidelines incorporating economic security, investors now model ICA national-security exposure during bid formation. Enforcement has bite: Ottawa ordered dissolutions in 2024 and issued further orders against sensitive tech firms in 2025, signals that widen the zone of deals likely to attract conditions or undertakings. Finally, look at resilience as a liquidity accelerator. The public sector’s Contract Security Program (PSPC), Controlled Goods Program, and industrial security protocols reward owners with security-qualified assets by smoothing diligence and procurement. For large institutional tenants, buildings that offer layered access, hardened MEP systems, redundancy, backup operations, and strict site control sail through leasing and negotiations. In this light, security features are no longer cost centres; they are value accelerants.

Resilience accelerates liquidity. Facilities, suppliers and personnel that satisfy PSPC’s Contract Security Program and the Controlled Goods Program move more cleanly through public-sector and defence-industrial leasing and procurement. Buildings with layered access, hardened MEP, redundancy and strict site control cut diligence time for institutional tenants; in other words, security features act as value accelerants, not cost centres.

The conclusion is straightforward: resilience, compliance and sovereign alignment are no longer fringe preferences; they are investment filters. In today’s market, no security = maximum discount. In short: without resilience, no liquidity; without compliance, no capital; without security, no city.

In the emerging global order, capital chases trust. Canada’s enduring strengths, its rule of law, institutional stability, and regulatory transparency, have become a form of financial armour. Global investors are now seeking safe, sober, sovereign jurisdictions for critical real assets, and this is where Canada can define distinct value. We can lead by design, not default:

Security as a service establishes standardised baseline protocols for cyber and physical compliance across portfolios and tenants.

Adjacency analytics, map militarised corridors, grid nodes, fibre backhaul, and federal assets to identify high-trust, high-yield sites.

ICA playbooks, time investments and undertakings to anticipate regulatory friction before it occurs.

Capex integration, treat resilience upgrades, shielding, access control, OT segmentation, as yield-accretive, not discretionary.

Canada may not always be the lowest-cost market, but it can be the most trusted. Most leaders still regard compliance as friction; I argue it is design. The baseline of sovereignty is no longer a constraint; it is infrastructure. Choose to lead. Invest in resilience. Design for clearance, segmentation, and agility. Do it now, because the budget tabled on November 4 will only harden the premium.

Security is not a cost; it is capital in motion.

The next cycle of Canadian real estate will turn not on density or rent spread, but on trust, alignment, and sovereign deliverability. Those who act on that insight will shape the standards by which value is measured.